Real Estate

June 26

Implementing the 50-30-20 rule for real estate investment

A solid financial plan is crucial for building a strong economic foundation, and the 50-30-20 rule can be an excellent starting point.

This rule helps you categorize your expenses into three main buckets, enabling you to take control, plan your spending, and progress toward your financial goals.

As a foreign investor, understanding and applying this rule can optimize your investment strategy and enhance your financial stability.

Understanding the 50-30-20 rule

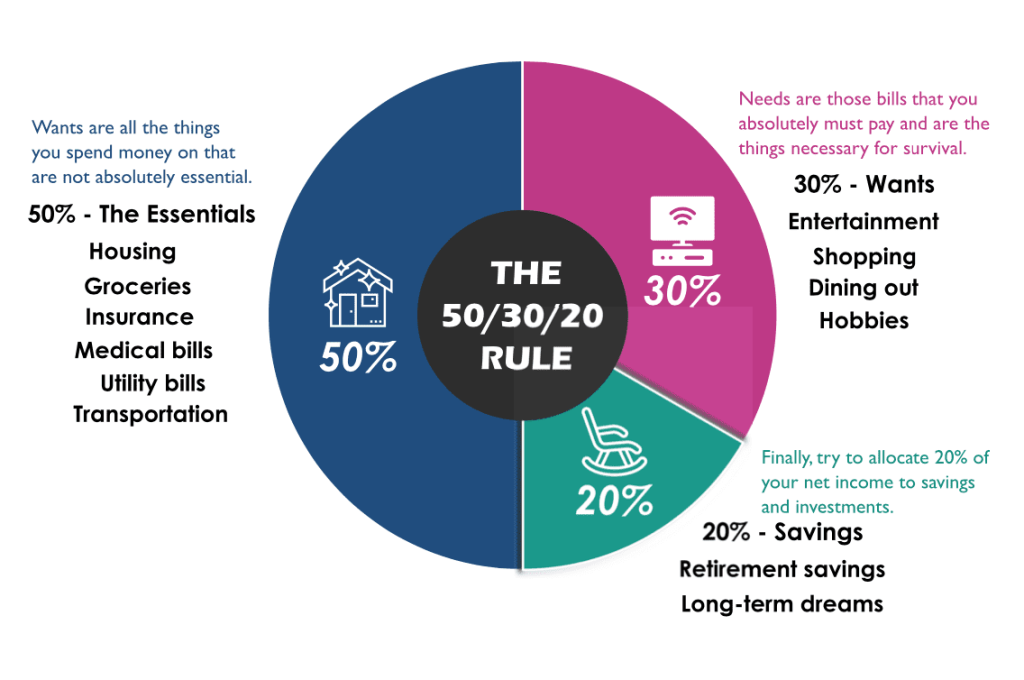

The 50-30-20 rule suggests allocating your income (after taxes) into three categories:

- 50% for needs: Essential expenses

- 30% for wants: Discretionary spending

- 20% for savings and goals: Investments and financial growth

Applying the 50% for needs

Needs are those essential expenses that you can’t avoid. Examples:

- Housing

- Transportation

- Food

- Essential clothing

- Utilities

- Medical care

Being honest with yourself about what constitutes a necessity is crucial. For example, having a vehicle may be essential to get to work, but it doesn’t necessarily need to be a luxury car.

Similarly, while we all need food and clothing, opting for gourmet foods or designer clothes may skew these expenses toward the wants category.

If your needs exceed 50% of your income, you may need to reconsider your spending and look for more economical alternatives.

Allocating 30% for wants

Wants are those expenses that make your life more enjoyable but are not essential. For example:

- Entertainment (such as streaming or cable subscriptions).

- Dining out

- Gym memberships

- Hobbies

- Personal care beyond the basics

- Cell phones beyond the basic plan

Often, what we consider a necessity may be a want. For example, while regular haircuts are a necessity, opting for a luxury salon is a want.

If your wants exceed 30% of your income, you may need to adjust these expenses and prioritize saving.

Reserving 20% for savings and goals

This category is crucial to securing your financial future. Here you can include:

- Savings for emergencies

- Additional payments to pay off debts

- Investments in Real Estate

- Saving for big goals such as travel or education

It is important not to include minimum monthly debt payments in this category, as these pertain to necessities. Instead, additional payments to accelerate debt cancellation can be included here.

If you find yourself without 20% available for savings, consider reducing spending on wants or needs to free up more funds for your goals.

Practical tips for real estate investment

Applying the 50-30-20 rule can be especially helpful when planning a real estate investment. Here are some tips on how to do so:

Assess needs (50%):

- Acquisition costs: Include the purchase price of the property, taxes, insurance, and closing costs.

- Maintenance and operations: Recurring expenses such as utilities, repairs, and property management.

Considering desires (30%):

- Improvements and renovations: Investments that increase the property value, such as luxury renovations, or non-essential additions.

- Additional services: Hire premium management or marketing services to attract high-profile tenants.

Savings and goals (20%):

- Emergency savings: Reserves for contingencies such as major repairs or periods without tenants.

- Property reinvestment: Funds earmarked for future real estate investments or prepayment of mortgages to increase your equity.

As a foreign investor in real estate, using the 50-30-20 rule can help you ensure that your essential needs are covered, your discretionary spending is controlled, and your savings and investment goals are prioritized.

By applying this rule, you can build a solid financial foundation and set yourself on the path to successful real estate investment.

If you are looking for a real estate oportunity in México, Puerto Escondido is a great choice. Contact Osan Puerto to discover the best investment opportunities in this destination.

You might be interested in:

Subscribe to our blog

and receive monthly our best Real Estate advice and news